The Central Provident Fund (CPF) is really a Obligatory price savings plan in some nations around the world, for instance Singapore, intended to assist citizens and permanent inhabitants conserve for retirement, Health care, and housing wants. 1 significant aspect of the CPF procedure could be the "contribution cap," which limits exactly how much might be contributed to an individual's CPF account each and every year.

Important Ideas

Contribution Limits

Yearly Restrict: There exists a maximum volume that can be contributed to your CPF accounts yearly from each employer and personnel contributions.

Every month Wage Ceiling: Contributions may also be capped dependant on a month-to-month wage ceiling. Consequently if you generate higher than this ceiling, only a portion of your wage up to your ceiling will be deemed for CPF contributions.

Sorts of Contributions

Everyday Wages (OW): These consist of standard profits like essential salary and allowances.

Extra Wages (AW): These contain bonuses or other non-common payments.

Allocation Throughout Accounts

The full contributions are divided among the three primary accounts:

Normal Account (OA): Used for housing, training, expenditure, and insurance plan.

Distinctive Account (SA): Generally for retirement purposes.

Medisave Account (MA): For medical costs and authorized healthcare insurance policy.

Useful Examples

Month-to-month Salary Case in point

Suppose you do have a regular wage of $6,000:

When the monthly wage ceiling is $six,000:

Your overall wage will likely be subject to CPF contributions.

If the every month wage ceiling ended up $5,000 rather:

Only $five,000 might be matter to CPF contributions Although you earn extra.

Yearly Bonus Case in point

Think about receiving an once-a-year bonus of $ten,000:

Added wages like this reward also contribute in direction of your annual contribution Restrict.

Should your total OW by now reaches near the once-a-year limit established by authorities ($37,740 as an example):

Only section or none of the bonus could count toward more contributions due to hitting the cap.

Why Contribution Caps check here Issue

Fairness: Ensures equitable treatment method across diverse income stages by capping high earners' Added benefits proportionately.

Sustainability: Assists retain long-expression sustainability of social stability techniques by protecting against excessively big particular person fund accumulations rapidly depleting assets.

Being familiar with these caps aids persons plan their finances greater though making certain compliance with nationwide restrictions about retirement financial savings strategies like CPF.

By greedy these fundamentals about contribution caps throughout the context you're knowledgeable about—like budgeting or conserving—you will discover it easier to manage simply how much goes into your obligatory price savings without exceeding legal limits!

Alana "Honey Boo Boo" Thompson Then & Now!

Alana "Honey Boo Boo" Thompson Then & Now! Joseph Mazzello Then & Now!

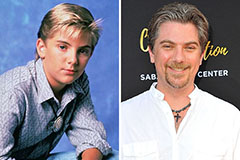

Joseph Mazzello Then & Now! Jeremy Miller Then & Now!

Jeremy Miller Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now! Stephen Hawking Then & Now!

Stephen Hawking Then & Now!